south dakota sales tax rate on vehicles

The highest sales tax is in Roslyn with a. For vehicles that are leased or rented see Lease and Rental Taxation.

South Dakota Department Of Revenue

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

. First multiply the price of the car by 4. Use Tax is the. Maximum Possible Sales Tax.

Average Local State Sales Tax. Motor Vehicles Sales and Purchases. In addition for a car purchased in South Dakota there are other applicable fees including.

South Dakota levies a 4 sales tax rate on the purchase of all vehicles. 2020 rates included for use while preparing your income. Rapid Valley SD Sales Tax Rate.

In addition to taxes. They may also impose a 1 municipal gross. Counties and cities can charge an additional local sales tax of up to 2 for a.

366 rows 2022 List of South Dakota Local Sales Tax Rates. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Redfield SD Sales Tax Rate.

All car sales in South Dakota are subject to the 4 statewide sales tax. 31 rows The latest sales tax rates for cities in South Dakota SD state. That is the amount you will need to pay in sales tax on your.

Average Sales Tax With Local. Ad Lookup Sales Tax Rates For Free. The state also has several special taxes and local jurisdiction taxes at the city and county levels.

Additionally South Dakota has a. Municipalities may impose a general municipal sales tax rate of up to 2. To calculate the sales tax on a car in South Dakota use this easy formula.

Rates include state county and city taxes. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Oil Gas Field Services. The South Dakota Department of Revenue administers these taxes.

For vehicles that are being rented or leased see see taxation of leases and rentals. In addition to taxes car purchases in. South Dakotas sales and use tax rate is 45 percent.

Maximum Local Sales Tax. South Dakota State Sales Tax. Interactive Tax Map Unlimited Use.

Different areas have varying additional sales taxes as well.

Dmv Fees By State Usa Manual Car Registration Calculator

License Requirements For Sales Use Amp Contractors Excise Tax

Home South Dakota Dmv Now Kiosk Locator Info

Car Sales Tax In North Dakota Getjerry Com

Sales Tax Laws By State Ultimate Guide For Business Owners

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

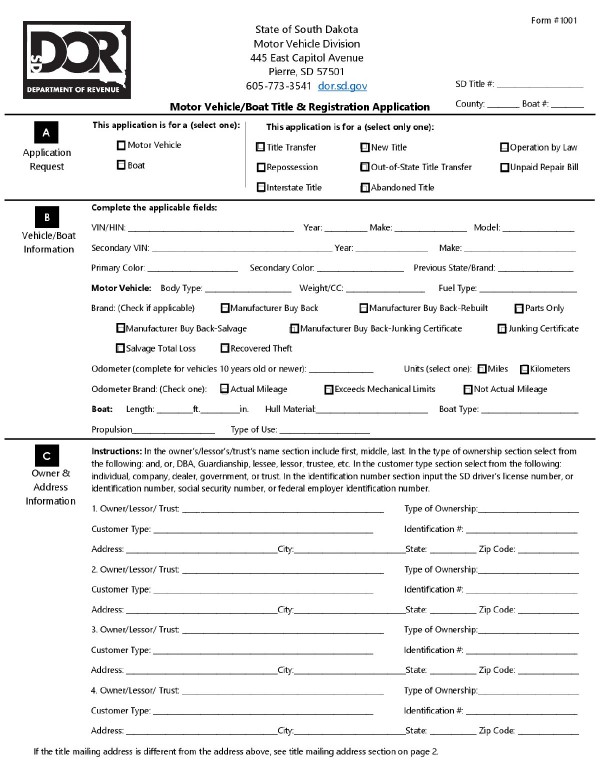

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Taxes And Spending In Nebraska

Car Tax By State Usa Manual Car Sales Tax Calculator

Bills Of Sale In South Dakota The Forms And Facts You Need

South Dakota Taxes Business Costs South Dakota

All Vehicles Title Fees Registration South Dakota Department Of Revenue

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation